Luxury Consumer Research and Insights

In 2017, the value of luxury goods within the UK alone reached approximately €55bn and their value has been rising annually since 2012.

With UK retail performance appearing seemingly dim and lots of scary talks afloat regarding the likelihood we’ll be facing another recession within two to five years (yet one more thing related to Brexit), it’s important to remember not all retail sectors are victims of financial downturn. Luxury consumers continue fighting the good fight when it comes to retail performance enjoying the finer things in life along the way, which is how the luxury market was one of the retail sectors to have survived the UK’s last financial crisis. Furthermore, despite luxury prices rising by 10 – 15% following the Brexit vote, the UK became the most affordable luxury market in which to shop.

Whilst it is arguable those with a high disposable income typically still have ‘cash to splash’, their disposable income is NOT their intent to purchase. It’s what makes purchasing more accessible to them but it’s not the reason they buy. Their disposable income however, is one factor to consider when deciding who our target audience is to market to and as Tim recently stated, “Marketing luxury goods involves an insightful approach to understanding the customers, what motivates them to buy and how they choose to do it.”

Luxury’s Relationship with Digital

Consumers who purchase online and instore spend ~50% more per year

In 2012:

- 51.4% of luxury brands reported digital marketing topped their list of areas to invest in

In 2013:

- Whilst overall luxury sales increased 2% year on year, online sales grew by 20%

- 54% of luxury shoppers confirmed they research online before buying. These consumers were from the UK topping the USA, France, Japan, Italy and China

In 2014:

- 3 out of 4 luxury shoppers owned a smartphone and half owned a tablet

By 2017:

- Online sales grew 24% year on year, with luxury brands advising purchases from eCommerce make up 31% of their total sales

Why They Love Luxury & How They Shop

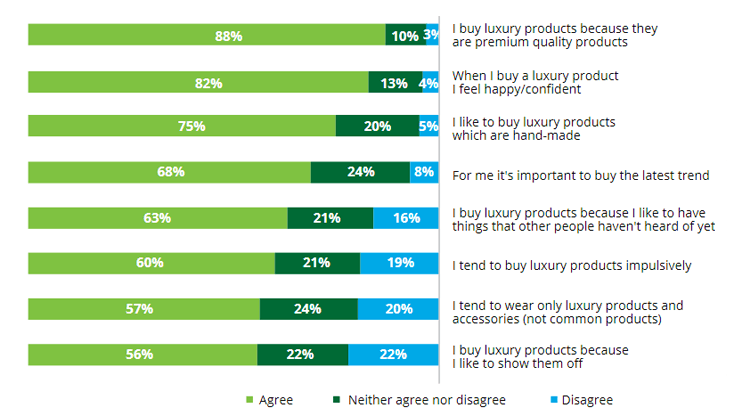

The Intent Behind Luxury Purchases

- 90% like to buy products which are hand-made

- 93% of shoppers buy luxury goods because they are ‘premium quality’

- 95% agreed when they buy a luxury product they feel happy/confident

That said…

- 89% avoid luxury products from brands who do not respect ecological sustainability

Photo credit: Deloitte

Desired Purchasing Channels

Whilst consumers buy luxury because of their premium quality and opulence, they aren’t entirely motivated by the in-store experience either. Convenience is a factor moving forward for luxury:

- 39% of luxury consumers want home delivery

…and why you should consider offering this if you’re a luxury brand

- Consumers who purchase online and instore spend ~50% more per year

If you fail to provide an eCommerce purchasing channel in addition to bricks and mortar stores, you could be seeing a lower annual spend (even average. customer value depending on the price of your products) than your competitors who have already taken the leap online. Remember, it’s not just about being online…it’s about making shopping accessible online. There are many ways you can try and bring your offline experience online to your consumers.

What Luxury Consumers Want

- 44% of consumers surveyed want to be rewarded for their loyalty, via gifts for example

- 45% want personalised products or services

Thinking about the above, you could:

- offer free gifts with purchase. This gives back to the consumer without appearing to discount or devalue the brand as there is a minimum purchase value required

- give previews for new product launches to existing customers, perhaps even giving the option to purchase a day before everyone else if you’re able to

- consider offering personalised products if your product offering permits this and you have the production line in place to offer this

- segment your email subscribers into segmented lists to offer a more personalised experience. Not just by gender, but more as a reflection of historical purchases and suggestions of what they might like to buy next. For example, if you’re a beauty brand and you know the customers who have purchased your day cream, you might want to suggest they try the night cream with an email to opt and receive a free sample to try

And if you thought luxury consumers were turned off by discounting, I can assure you they’re very much turned on…and some luxury brands are only too happy to satisfy their needs:

- Luxury labels and retailers were responsible for the highest volume of discounts in the USA over Black Friday 2017, with premium brands discounting on average up to 20-24%

Photo credit: [Public domain], via Wikimedia Commons

So if you haven’t participated in Black Friday yet, perhaps you should start thinking about what your strategy should be for Black Friday 2018. For more eCommerce and online shopping statistics, join the ThoughtShift Guest List and get the latest award winning eCommerce blogs delivered to your inbox each month or ask us for a free eCommerce marketing analysis of your website.

Resources:

- http://www.bain.com/about/press/press-releases/press-release-2017-global-fall-luxury-market-study.aspx

- https://www2.deloitte.com/content/dam/Deloitte/global/Documents/consumer-industrial-products/gx-cip-global-powers-luxury-2017.pdf

- https://www.independent.co.uk/life-style/fashion/death-of-retail-2017-was-all-about-the-empire-of-luxury-e-tail-a8096761.html

- http://www.ecommerceweek.co.uk/news/537/luxury-brands-failing-to-connect-online-and-offline-experience/