Preparing Retailers For Q4 2020

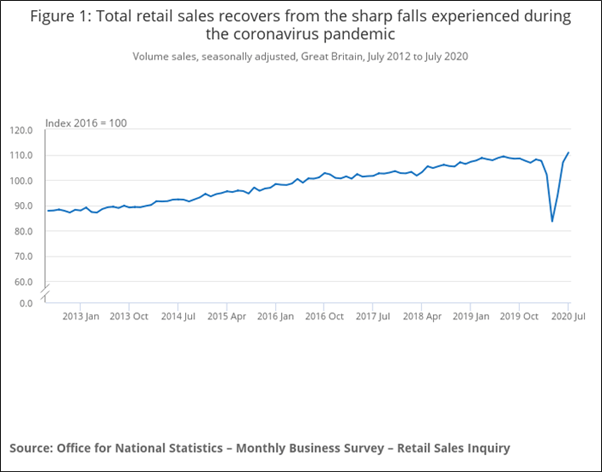

In the Office for National Statistics’ Retail Sales for Great Britain July 2020 report we can see some very clear changes in consumer purchasing behaviour in the UK. Let’s delve into what trends we can see and what it may mean for retailers in the UK for the remainder of 2020 and beyond. It is first important to note that in July 2020 overall retail sales volumes in the UK rose by 3.6% compared to June 2020 and were 3% higher than the pre-COVID benchmark month of February 2020.

New Purchasing Behaviours

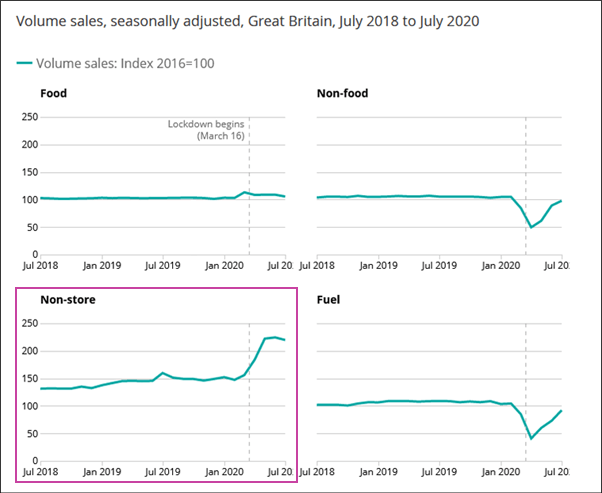

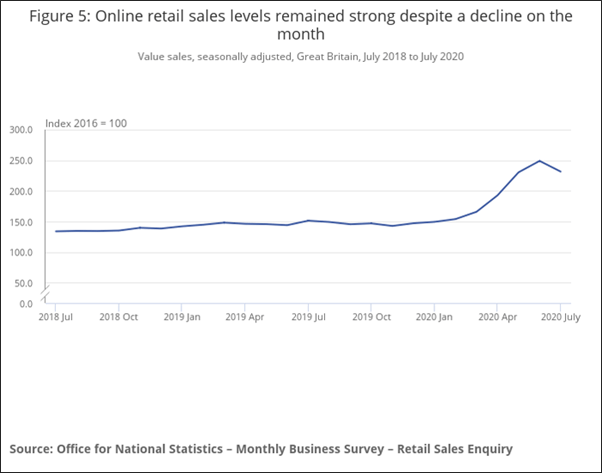

So, what are the new purchasing behaviours? In July there was a 2.1% decline in non-store retail sales volume compared to June 2020, which is considered to be due to the re-opening of stores across the UK at the beginning of July. However, despite the option of shopping in store becoming widely re-available to consumers in July, the volume of non-store retail sales in the UK in July 2020 was 49.2% higher than in February 2020.

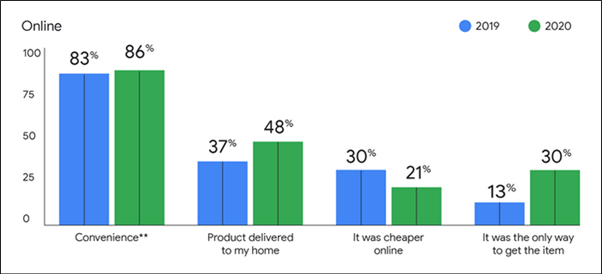

In a Google survey of UK consumers when asked about the motivations behind making an online purchase convenience and home delivery were considerably more important than price:

When asked specifically about the motivations behind trying new retailers (online and offline) in Google’s survey UK shoppers said that their main motivations were:

- Availability of the product

- Price

- Convenience

- Speed

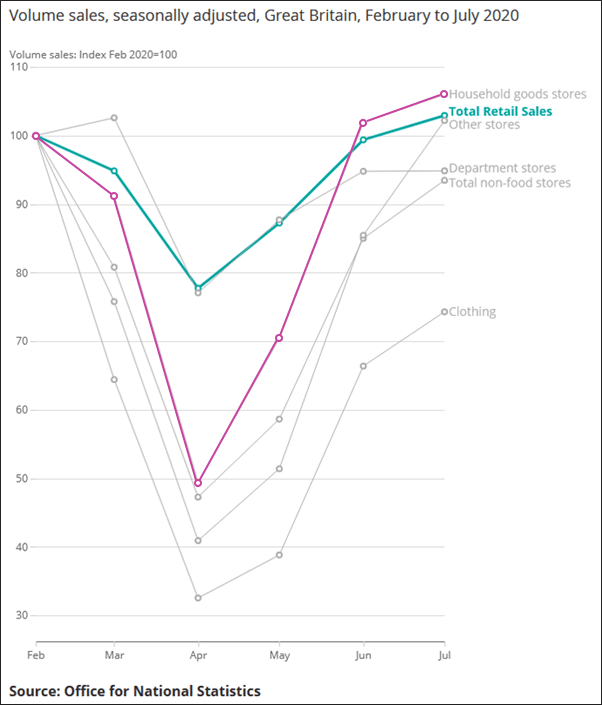

Household Goods Are Recovering Fastest

Perhaps unsurprisingly after spending so much time at home, UK consumers were buying more household goods in July than in February. Household Goods was the first non-food retail store category to recover to (and exceed) February 2020 levels in June and the trend has continued with further growth in July:

Online Retailing Trends

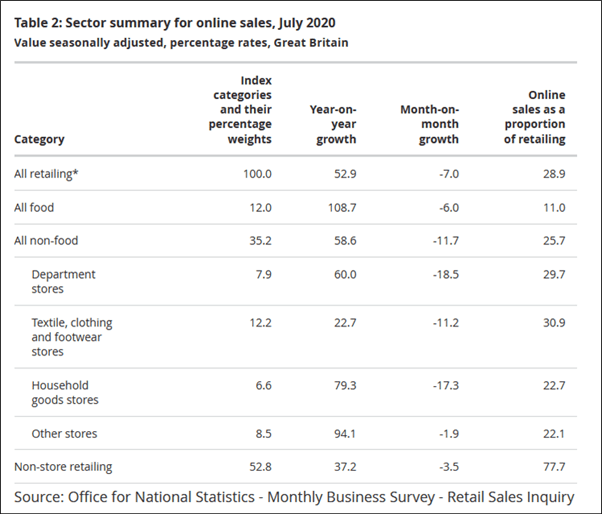

The value of online sales as a proportion of all retailing in the UK in July was 28.9% (including food and fuel). 25.7% of non-food revenue in the UK in July was processed as an online transaction. 77.7% of non-store retail revenue was online purchasing.

When compared to July 2019 all non-food retailing saw a 58.6% increase in online revenue, department stores saw a 60% increase, textile, clothing and footwear saw a 22.7% increase and household goods saw a 79.3% increase in online revenue:

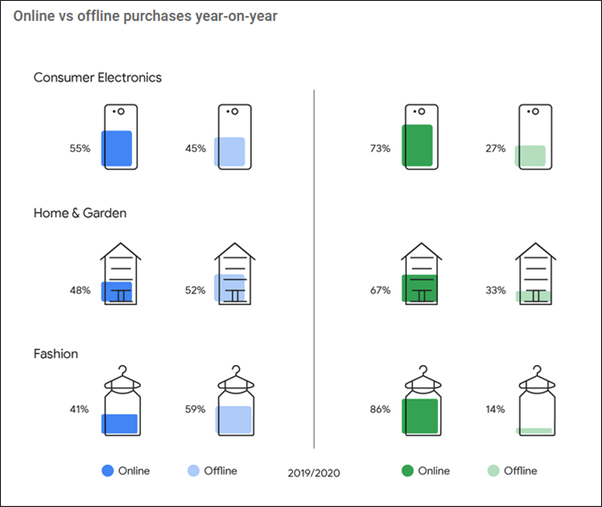

In Google’s Smart Shopper survey from May 2020 they found that whilst all product categories had seen a growth in online purchases, compared to 2019, fashion saw the biggest growth:

Google’s survey also asked UK shoppers about their pain points when making purchases and these included the need to register/login before making a purchase, slow customer service response times and challenges in finding product reviews.

Plans For 2020

As many businesses are looking to make up their revenue shortfall from Q2 and to some extent Q3 and/or shift old season stock, close down stores and keep their heads above water and team members employed, competition is going to be fierce moving in to Q4.

Discounting Is Not The Answer

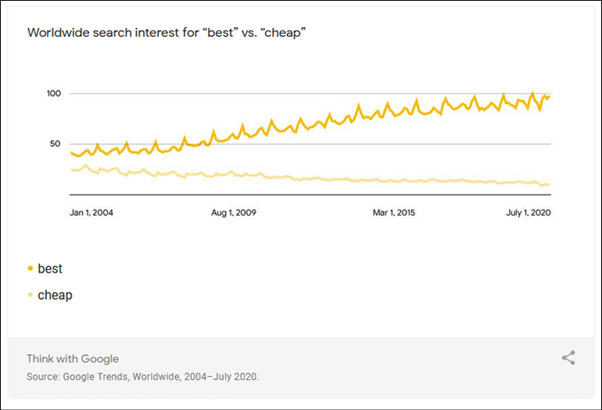

As we have seen, the motivations behind whether someone buys online or instore and why they have selected a new retailer have not been led by price. Whilst being price competitive is important these studies have shown that stock levels/availability and home delivery lead times and cost are far more important to consumers. Furthermore, we can see that worldwide interest on Google for terms including “best” has been rising since 2004 whilst worldwide interest for terms including “cheap” has been declining:

Rather than relying on price reductions brands should be focusing on establishing reliable, low cost distribution networks and focusing marketing efforts on products with a high volume of stock. Building brand reputation and product reviews that will validate competing for “best” terms will also be an extremely worthwhile endeavour now and into the future.

Another Google survey of UK shoppers looking at the impact of COVID-19 carried out in June 2020 also found that more than 1/3 of UK shoppers who normally shop in-store for Black Friday will not be doing so this year. Of those shoppers who do intend to purchase in-store this Christmas period, 65% said that they intend to confirm online that a product is in stock before going to buy it. 68% said that they intend to plan their shopping earlier to avoid crowds and 80% of planned shoppers will complete their Christmas shopping in fewer trips than previous years. 67% of shoppers surveyed said that they intend to shop more at local small businesses.

Here are some top tips for optimising your online performance and therefore revenue as we move into what is traditionally the busiest time of year for many retailers anyway:

- Make sure that your website adheres to Google’s best practice and is optimised for organic search visibility

- Develop a marketing strategy that will build your brand reputation and awareness, as well as your immediate revenue, for long term benefit

- Plan your Black Friday SEO strategy in advance and stick to it, bearing in mind the intended shopping behaviours of UK consumers

- Build your reputation now, develop a customer review strategy and encourage people to talk about their great experiences with you

- Review your online customer service channels. Can online chat functions be added to your site? Can you increase your customer service call centre capacity? Or can you simply provide more product information on your website? More detailed descriptions, FAQs or video demos. If your stores are less busy could retail staff who are familiar with selling these products support in these activities?

- Nurture your brand’s following on social media, share stories, encourage your customers to share their stories. Talk about your ethics as a business. These channels which are difficult to attribute last-click ROI against will be invaluable when consumers have a limited gifting budget and a lot of retailers to choose from

- Google’s survey found that 62% of UK shoppers care about at least one sustainability aspect when purchasing online. This could include fair working conditions, diversity and inclusion, environmentally friendly production, avoiding harmful ingredients, degradable packaging or minimising product miles

If you would like help developing a digital marketing strategy to get you through 2020 then contact us. Our Digital Strategists developed our digital strategy service with the current situation in mind and are well placed to work with you to develop a plan that you can manage and afford.

Sources

- Featured image by Rupixen

- Office for National Statistics

- Office for National Statistics

- Think With Google/

- Office for National Statistics

- Office for National Statistics

- Office for National Statistics

- Think with Google

- Think with Google

Follow my contributions to the blog to find out more about digital marketing strategies, or sign up to the ThoughtShift Guest List, our monthly email, to keep up-to-date on all our blogposts, guides and events.